Tradget

Project Overview

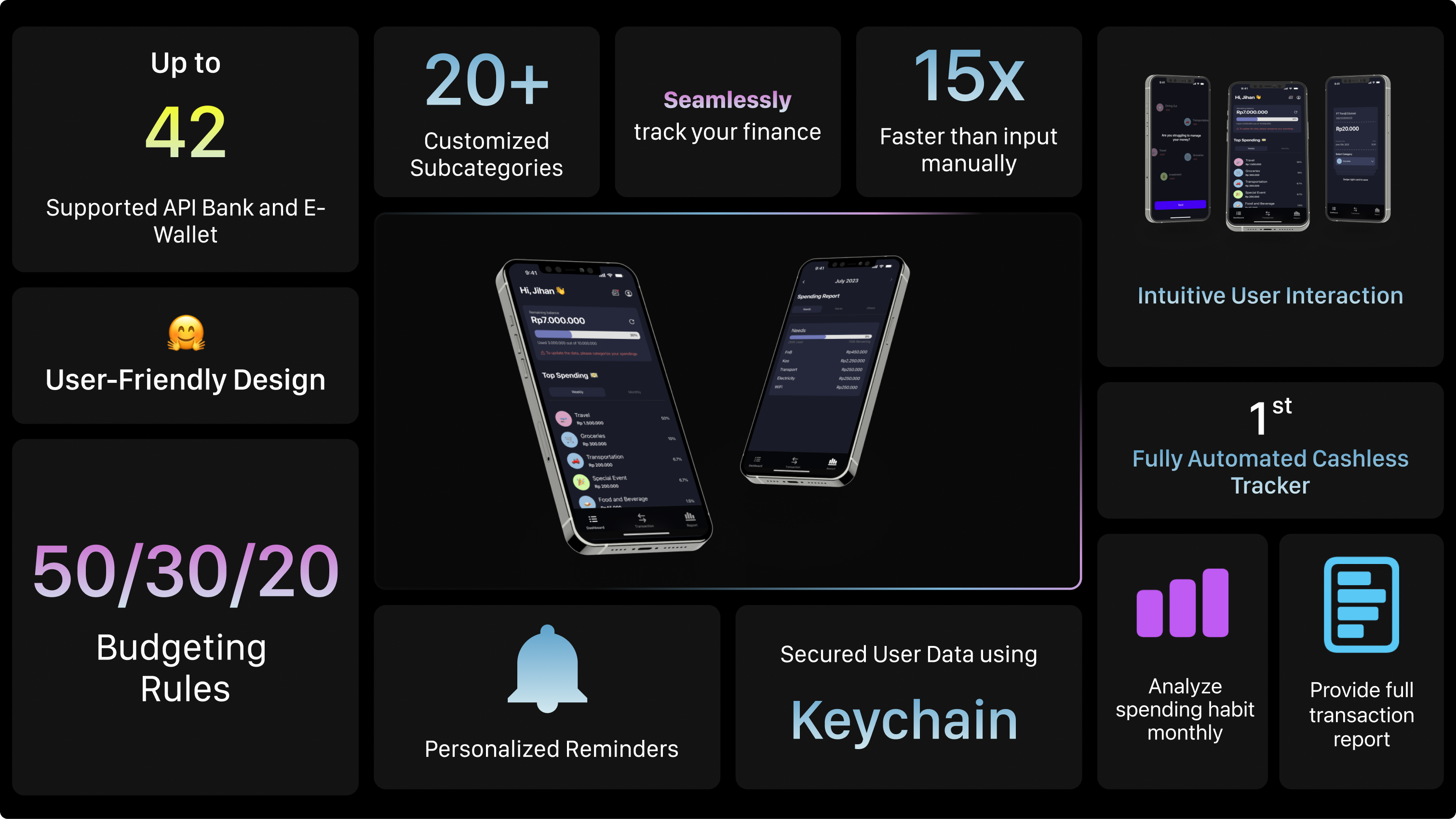

Tradget is an innovative budget tracking and management app catering to the unique needs of first jobbers. Our mission is to empower individuals in their transition into the workforce by offering a user-friendly platform that simplifies personal finance management. With personalized recommendations, savings strategies, and insightful budgeting tools, our app equips users with the knowledge and tools to make informed financial decisions, establish healthy habits, and work towards long-term financial stability.

Project Details

My Role

Solo Product Designer

Team

- Muhammad Rifqy, Project Manager

- Dimas Ashidiqi, iOS Developer

- Alfi Jihan, Tech Lead

- Handy Darmawan, iOS Developer

- Geraldy Kumara, iOS Developer

- Ignasius Joshua, iOS Developer

Timeline

1.5 months

Tools

Figma, Miro

Objectives

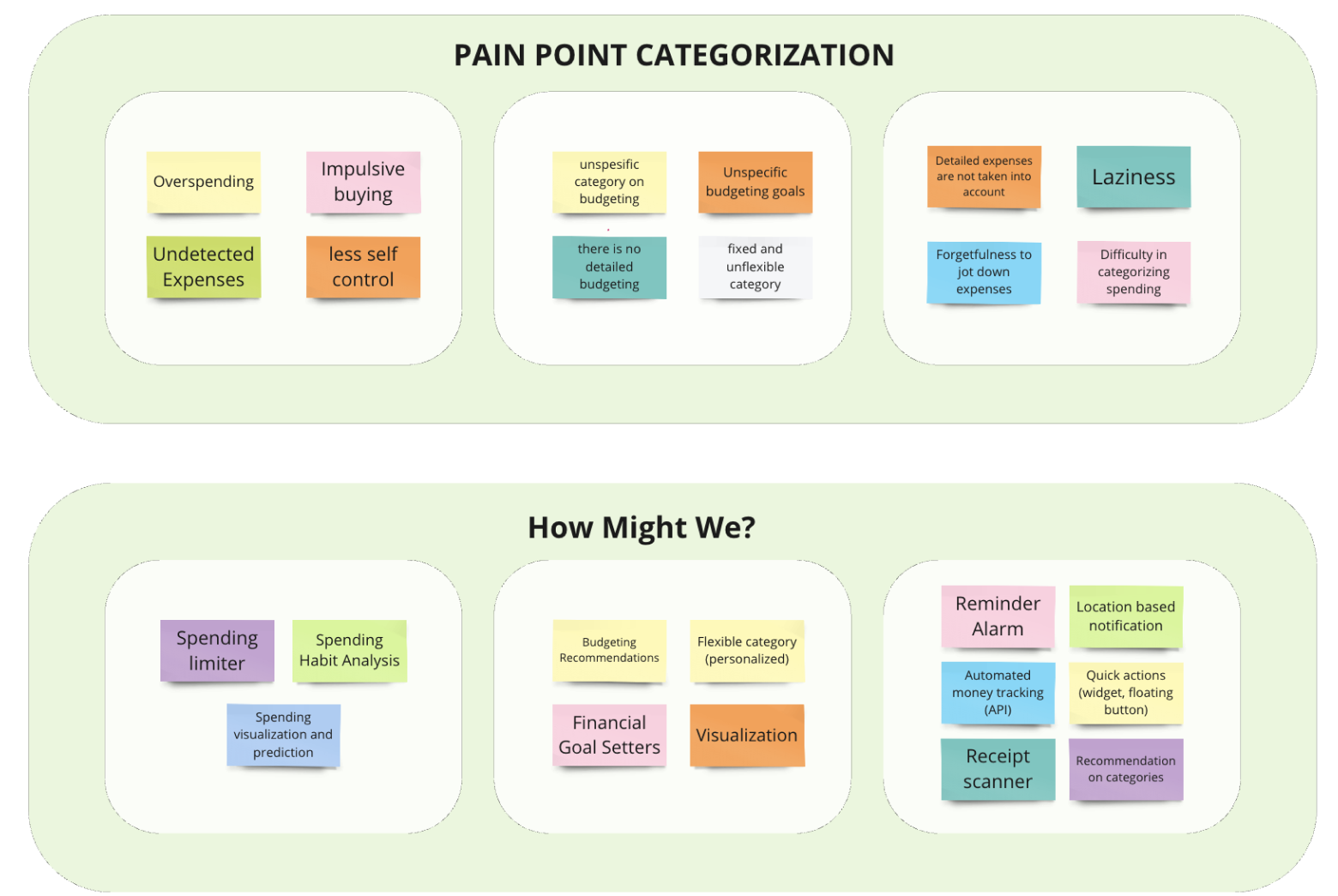

Many first jobbers encounter significant challenges when it comes to effectively managing their finances, which can hinder their financial stability and impede their progress towards long-term goals. The primary factors contributing to these difficulties include a lack of financial knowledge, a tendency to overlook expense analysis, and impulsive spending habits. As a result, first jobbers often find themselves facing empty pockets and limited savings.

Challenges in a nutshell:

How might we help people manage finances in 4.0 technologies era where they use various banks and e-wallets effortlessly?

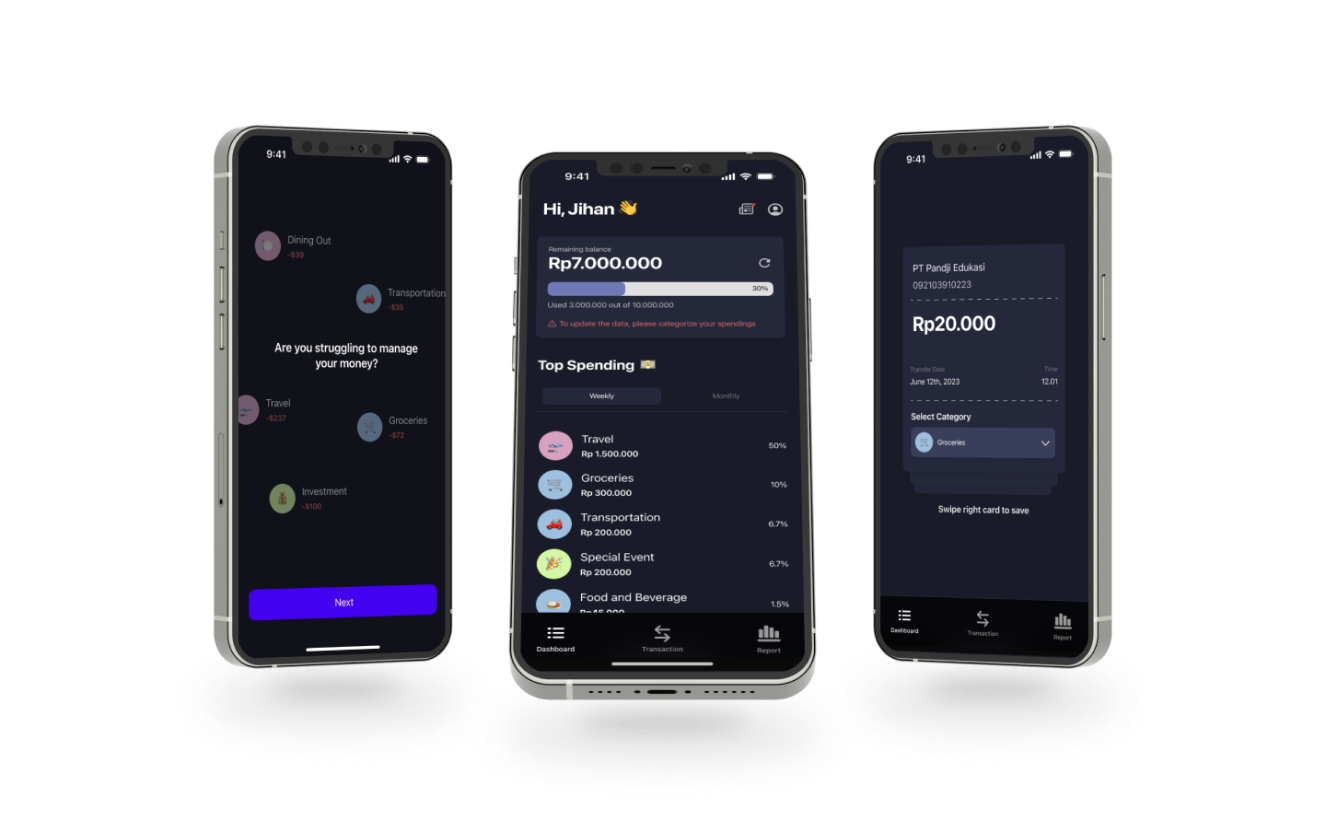

Highlighted Design Feature

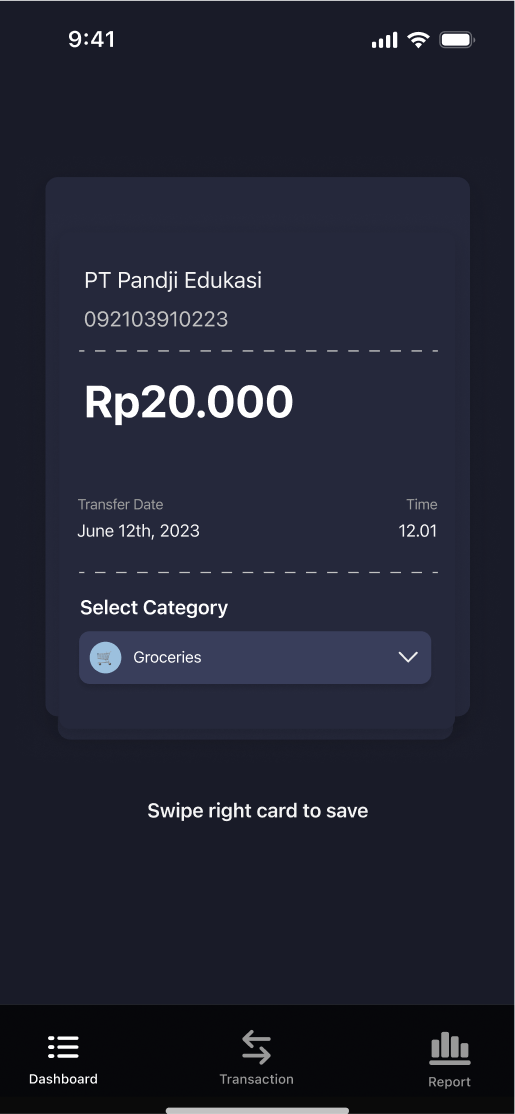

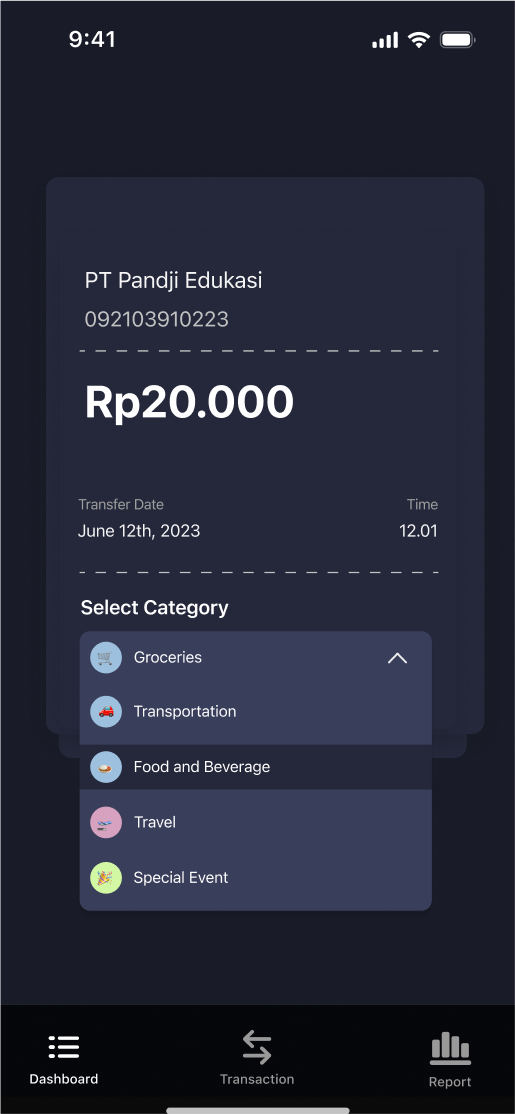

(1) Card Stack Categorization

(2) Select categories if not match

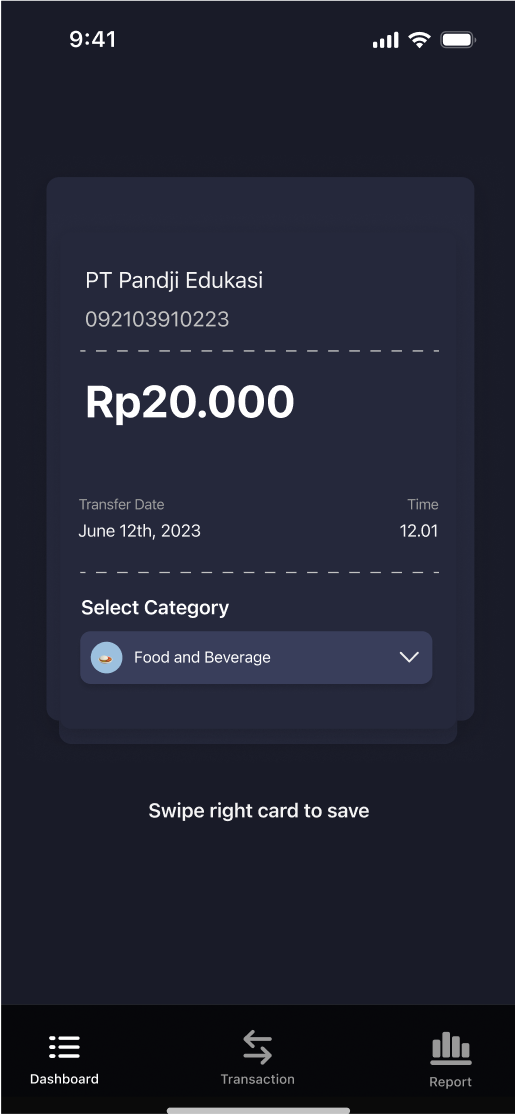

(3) Category changed

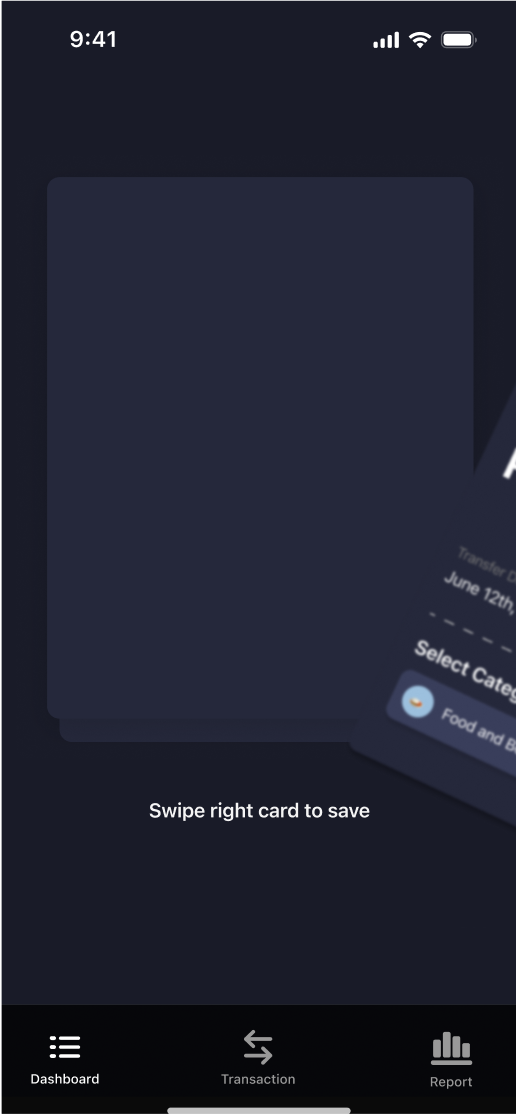

(4) Swipe right to save

The card stack interaction used in expense categorization is underpinned by principles of cognitive science and interaction design. Here's a more detailed breakdown:

- Leveraging Visual Patterns: The card stack interaction capitalizes on human visual cognition. By presenting one expense category at a time, users are guided through the categorization process in a way that aligns with their natural visual patterns. This reduces cognitive load as users don't have to process a plethora of information at once. Instead, they can focus on one item, making decisions more swiftly and accurately.

- Swipe-Right Engagement: The swipe-right action adds an element of familiarity and engagement. It mirrors interactions from popular dating apps like Tinder, where users are accustomed to making quick decisions with a simple swipe. This not only eases the categorization process but also injects an element of enjoyment into the task. When an interaction feels familiar, users are more likely to engage with it.

- Error-Tolerance Principles:The inclusion of an error-correction dropdown is a thoughtful UI design choice. It aligns with the principles of error tolerance in user interface design. Recognizing that users may occasionally make categorization mistakes, the dropdown provides a seamless means of correction. This minimizes user frustration, as they don't need to start the process over. It's a practical application of human-computer interaction theory that enhances the user experience.

In summary, the card stack interaction is not just a design choice; it's a well-considered application of cognitive science and interaction design principles. It optimizes the user experience by simplifying the task, engaging users, and accommodating the occasional errors that can naturally occur in the categorization process.

Solutions

- Automated Tracking: Syncs with bank accounts for automatic expense tracking.

- Personalized Budgets: Offers tailored budget recommendations.

- Actionable Insights: Provides guidance to build strong financial habits.

- Goal Setting: Tracks financial goals and progress.

- Education: Enhances financial knowledge through resources.

However, there are also some assumptions and dependencies that need to be jotted down

Assumptions:

- Users will understand that consistent input of their expenses is necessary to gain insights into their spending habits and effectively manage their finances.

- Users will recognize the benefits of tracking their expenses, such as gaining control over their finances, identifying areas for improvement, and achieving their financial goals.

Dependencies:

- The integration of reliable and secure APIs from financial institutions and payment platforms is essential to streamline the process of expense tracking and provide accurate financial data for users.

Result

A financial tracker that is powered by API to retrieve financial data from various e-wallet and bank accounts, with automated categorizations that also offer flexibility in it. All combined with the suggested budgeting ratio.